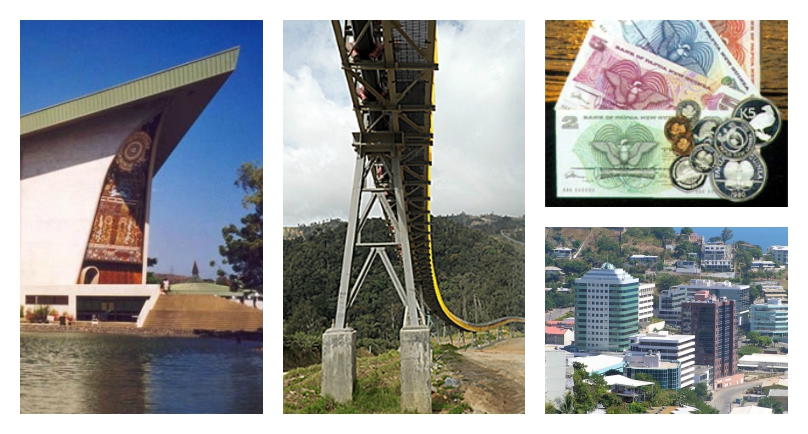

Oxford Business Update: Papua New Guinea Economy Shifts Down A Gear

Falling commodity prices and a slowing economy will cut into Papua New Guinea’s national revenue this year, although with growth levels forecast at 10 per cent or more, the impact of any downturn may be softer than expected.

In its Mid-Year Economic and Fiscal Outlook (MYEFO) published in August, the Treasury noted that a decline in commodity prices had impacted the domestic economy. While state spending on infrastructure may offset some of the slowdown, sectors such as agriculture and mining would be negatively impacted. The government deficit will also come under further pressure this year according to the new estimates, potentially denting investor confidence and the long-term growth picture.

Among the report’s key findings was that GDP would expand by 11 per cent in 2015, a considerable drop from the 15.5 per cent projected in the 2015 budget. Despite the less optimistic outlook, PNG’s projected rate of growth is still more than three times the IMF’s 3.3 per cent global economic growth forecast from July, which was cited in the report.

While PNG’s mining and quarrying sector had been expected to rebound this year after a 1.9 per cent contraction in 2014, the outlook for the economy’s non-mining sectors is not as optimistic.

An anticipated 3.3 per cent in non-mining GDP growth falls short of the 4 per cent forecast in the 2015 budget, although still a marked improvement on the 1.2 per cent-growth posted in 2014. The slowdown is mainly attributed to the winding down of development work on major energy enterprises such as the PNG LNG project, which came on line last year.

2015 expectations

Falling commodity prices have cut into revenue so far this year, with the decline expected to continue over the medium term.

“Risks have emerged from the deterioration of the government fiscal balance as a result of lower than expected revenue due to low commodity prices, while the expenditure cut exercise may be insufficient to fully compensate for this,” the MYEFO noted.

As a result, a decline in state revenue and grants is anticipated. Levels are expected to slip to PGK11.4bn ($4.05bn) this year from PGK13.9bn ($4.9bn) in 2014, a slowdown that could contribute to a rise in national debt. As of June, PNG’s debt-to-GDP ratio was 33.5 per cent, with the potential to increase to 41.3 per cent by the end of the year according to the MYEFO estimates, which would push debt levels above the legislative limit of 35 per cent.

The suspension of operations at the state-owned OK Tedi copper and gold mine, announced in late July, is expected to add to fiscal pressures, with the open-pit project accounting for a quarter of government revenues and 5.5 per cent of GDP, according to regional media.

In addition to lacklustre commodity prices, the mine has been affected by low water levels on the 1,050-km Fly River, a key transport link for receiving supplies like diesel and shipping condensate to Port Moresby for export. With the dry season in the Western Province expected to conclude in December, the mine could see operations resume in the coming months, though some question whether copper prices will be commercially viable at that stage.

Budget levels in the resource-dependent nation are heavily based on commodity prices including oil, gold and copper. In the light of global economic developments, including slowing demand for a number of PNG export commodities, the MYEFO saw a number of baseline assumptions revised, with the price of oil reduced to $52.00 per barrel – from the budget assumption of $89.7 − and forward pricing for both copper and gold cut from $6,947 to $5,818 per tonne and $1,277 to $1,192 per oz, respectively.

Growth forecasts

Despite the shadow cast by the MYEFO, PNG’s central bank has forecast GDP to expand in line with 2014 rates, with growth of around 10 per cent projected for this year. A

ccording to Loi Bakani, Governor of the Bank of PNG (BPNG), positive economic growth is a significant achievement in light of falling energy prices and the general slowdown in international markets.

“Although domestically this may appear to fall short of expectations, considering the outdated higher oil predictions, it is a positive outcome, especially considering the sluggish global economy,” he told OBG earlier this year.

Prime Minister Peter O’Neill echoed this sentiment, noting that the overall economy is stable with largely domestic debt and good cover in foreign exchange reserves. Nonetheless, cuts are going be made to non-priority areas, excluding health, education, law and order, and infrastructure, he added.

However, the report has also fuelled criticism that PNG’s economic situation is weaker than the government acknowledges. With a projected year-end deficit equal to 9.4 per cent of GDP – versus the budget figure of 4.4 per cent – and foreign currency reserves dipping nearly 5 per cent to PGK5.53m ($1.97m) as of the end of May, opponents are looking for change.

A large government deficit could hurt investor confidence in PNG, with ratings agency Moody’s placing PNG on a negative outlook in May, in part due to its fiscal deficit.

Speaking to the press earlier in August, Opposition Leader, Don Polye, said the government needs to cut back on expensive infrastructure projects in and around the capital and avoid further cuts to sectors such as education and health.

For more information, visit the Oxford Business Group, Papua New Guinea