By: Adelaide Kari – EMTV News, Port Moresby

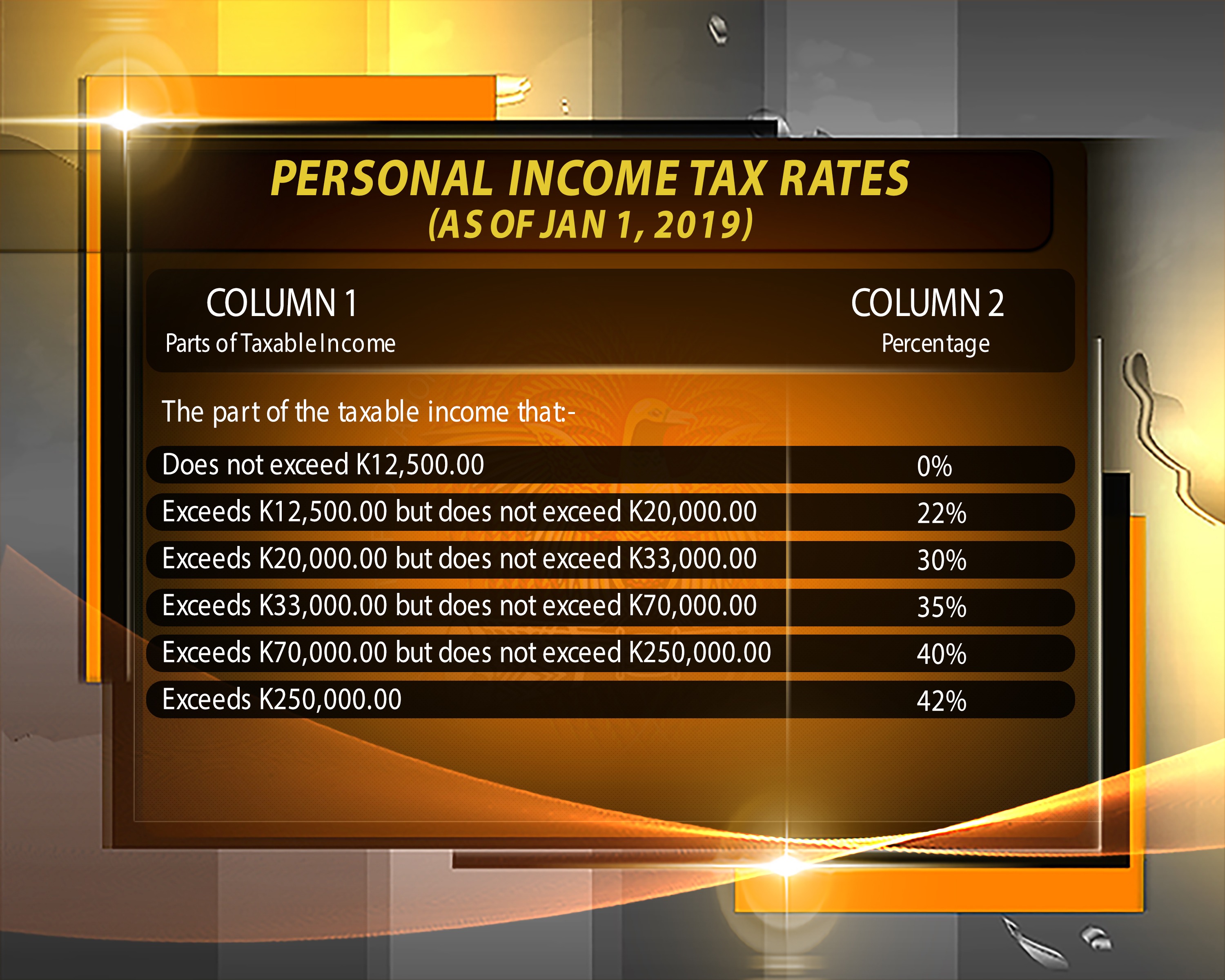

With the New Year come new taxes, for the working class the Income Tax as of today those earning and not exceeding K12, 500 a year will be tax free.

Those earning K12, 500 will be taxed 22%

Those exceeding K12, 500 but not exceeding K20, 000 Will be taxed 30%, K20, 000 and not exceeding K33, 000 will be taxed 35%, K33,000 and not exceeding K70,000 will be taxed 40%,K70,000 but not exceeding K250,000, 42% and for earning more than K250,000 will be taxed 42%.

Compared from 2018, the difference is the increase in the range, in 2018 the Income tax rate started from K10,00 – K18, 000 while for 2019, k12,500 – K20, 000, which means taxpayers are expected a 10- 20% increase in tax for 2019.

While minimum paid wage earners will be the winner of the amendments for 2019, the taxpayers hit the hardest will be the average and high paid taxpayers.

But those who will see the biggest difference are the public servants, as private sectors enforce salary sacrifices that are usually tax free under IRC, while for public servants it is non-existent.

For import goods and products customers should expect an increase for Fishery, dairy, meat, poultry, tinned products, cigarettes and alcoholic beverages. The increases what look to be the governments support to encouraging the local market growth for imported goods and produce but at the same time affecting the local market. The disadvantage for eg, Tinned products like Tin fish that is consumed by many Papua New Guinean household will see an increase from 10% to 25 impact on pricing. UHT and Dairy products from being tax free to an increase of 25%, wheat or meslin flour also seeing a 25% hike.

Meanwhile 2019 will also see 10% Goods and services tax added to all supplies made to mining, petroleum or gas companies where previously a zero-rating status was placed. When the 2019 budget was passed treasurer Charles able said The amendments were intended to safeguard government revenue and the administration of the tax became too complex and abused.

All in all 2019 the O’Neill- Able government has stressed that it will be a year the government has committed to ensuring that all tax owed will be collected.