LNG prices have surged and oil prices are stable, while cocoa prices are up but coffee is down. Business Advantage PNG’s monthly review of Papua New Guinea commodities and financial markets.

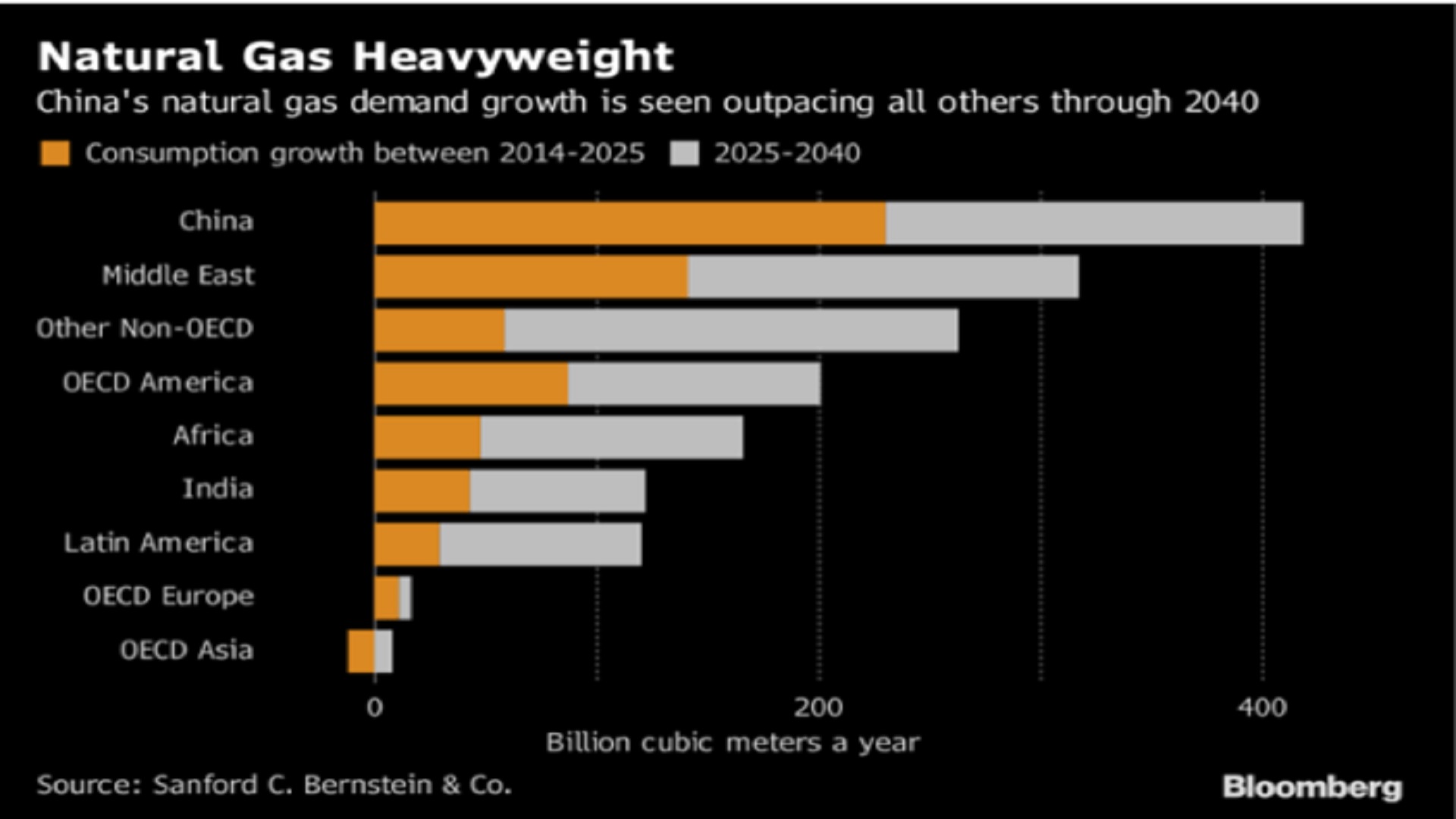

Projections of gas demand Source: Bloomberg,, Sanford C. Bernstein & Co.

According to Kina Securities the LNG price rose by 13.4 per cent over the month. This equates to a rise of 12.8 per cent over the last 12 months.

The long-term prospects for gas prices seem sound. According to a report by Sanford C. Bernstein & Co, China is in a ‘golden age’ for natural gas that will make it the world’s biggest user of the fuel sometime between 2040 and 2050.

The report claims that the boom in demand reflects the Chinese government’s intent to respond to growing pollution problems by shifting its economy away from dirtier fuels like coal and petroleum.

Meanwhile, the oil price has done little. West Texas Intermediate was down by 0.6 per cent over the month and is down 3.4 per cent for the year, according to Kina.

‘Copper continued to surge, which is good news for the PNG economy.’

The longer term trends with oil may be more encouraging. According to Fortune magazine Brent crude (another commonly-used oil benchmark) is near its highest level in two years.

‘A global glut is being absorbed as the world economy enjoys the most broad-based period of growth in a decade. After ballooning in 2016, the developed world’s crude stocks are now—almost—back in their historical range.’

Precious metals

Precious metals prices have been weaker. Gold is US$1,281 an ounce, which is down 2.3 per cent per cent for the month, although it is up 11.2 per cent over the year, according to Kina.

‘Agriculture prices were mixed.’

The silver price was slightly weaker, down 0.4 per cent over the month. It is up 6.8 per cent over the year, however.

The copper price since early 2016 Source: Market Index

Copper continued to surge, which is good news for the PNG economy and foreign exchange situation. It was up 8.5 per cent over the month and has risen 27.2 per cent over the year, according to Kina.

Agriculture

Agriculture prices were mixed. The palm oil price fell by 1.9 per cent for the month. It is down 14 per cent over the year.

The cocoa price was strong, however. It was up 7.2 per cent over the month, which almost brings the price to where it was a year ago.

‘The stock market moved sideways.’

On the other hand, coffee prices remain weak. They were down 5.5 per cent over the month and are down 9.3 per cent over the year.

Equities

Papua New Guinea’s stock market moved sideways. The KSI Home Index (PNG-listed stocks only) fell by 0.1 per cent over the month but it is up 3.5 per cent for the year, reports Kina.

The KSI Index (which includes dual-listed stocks as well) rose 1.6 per cent in the month and is up 9.9 per cent for the year.

The Australian All Ordinaries Index rose slightly. It was up by 3.8 per cent over the month and is up 4.2 per cent over the year. America’s S&P 500 was up 4.4 per cent in the month and has risen 17.8 per cent over the year.

Airlines PNG surged 71.4 per cent over the month, but is still 20 per cent below its level at the same time last year.

The Kina was steady against the US dollar but continued to fall against the Australian dollar. It was down 1.7 per cent against the A$ in the last month and has fallen by 8.4 per cent over the last year. Oil Search rose by 4.7 per cent in the month. ASX-listed Highlands Pacific rose 15.9 per cent over the month, and is up 30.4 per cent for the year.

Half-year Treasury Bills are 4.73 per cent, while full-year Bills are 8 per cent. Five year Inscribed Stock has an interest yield of 10.53 per cent.