Businesses in Papua New Guinea will now have access to deeper and more diversified capital markets under a landmark reform which is expected to generate benefits for the broader economy.

The Securities Commission (Wholesale Corporate Bonds) Order 2023, endorsed by the PNG Ministry for International Trade and Investment (MITI), has expanded the bond market in PNG by providing a regulatory framework that enables funds to be raised through the issuance of wholesale corporate bonds.

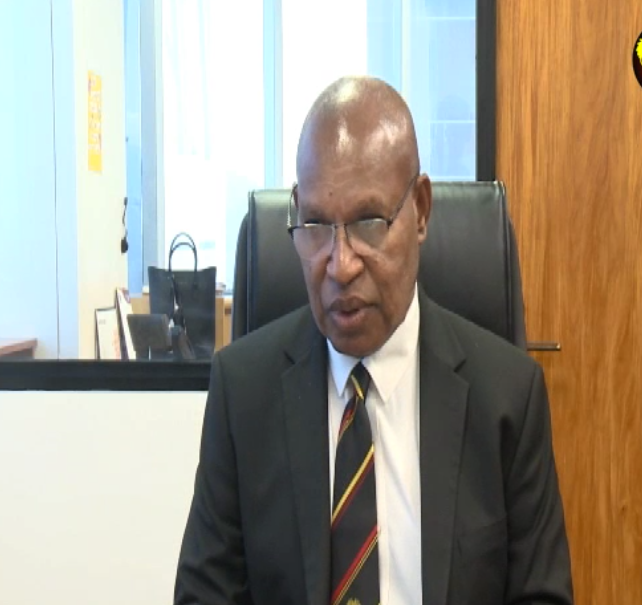

This important reform provides access to alternative sources of funding that can help businesses grow to help generate economic activities and jobs. The simplified process also ensures transparency before and after bonds is issued to limit risks to investors. This was expressed by the Minister for International Trade and Investment Richard Maru.

“Corporate bonds are important components of an active capital market and critical to the national development agenda as they open up a range of benefits for issuers, investors, and participants in the wider economy.”

This ranges from diversification of funding within the economy to investment diversification which includes better meeting the needs of institutional investors,” Minister Maru said.

As a member of the World Bank Group, IFC with the support of the governments of Australia and New Zealand, worked closely with the Securities Commission of Papua New Guinea (SCPNG) and the Papua New Guinea National Stock Exchange (PNGX) develop the regulatory orders under the Capital Market Act 2015 and related market rules that paved the way for the launch of a wholesale corporate bond market. This work followed a 2018 study by IFC into PNG’s corporate bond market which found there were legal and regulatory gaps that needed to be addressed.

“Having a wholesale corporate bond market will make PNG’s financial sector more competitive because it will allow companies to have access to an alternative financing instrument to raise funds. Moreover, investors are also able to diversify investments to reduce both their capital risks and the volatility of returns by investing in corporate bonds,” IFC Resident Representative to Papua New Guinea, Markus Scheuermaier said.

Australian High Commissioner to Papua New Guinea Jon Philp said Australia is pleased to support the IFC-PNG Partnership for the broader development of PNG capital markets.

“We are excited about the opportunities that will come from the new Securities Commission (Wholesale Corporate) Order 2023. The Australian Government is committed to supporting PNG to develop pathways to economic growth. We see further development of capital markets as critical to strengthening private sector growth and PNG’s long-term economic prosperity,” Philp said.

Consultations were held with potential issuers, investors, intermediaries, and other market practitioners as part of the work to develop the new regulations and rules.

The New Zealand High Commissioner to Papua New Guinea, Peter Zwart said they are really pleased to see the development of a wholesale corporate bond market in Papua New Guinea.

“This market will add an important new financing option for local businesses and is a significant step forward in building competitive and diversified financial services,” Zwart said.

“An effective and transparent financial sector is key to the ability of the private sector to invest in and grow the businesses opportunities and jobs Papua New Guinea needs,” he said.

PNG Government has been a strong advocate of the need to develop the nation’s financial market. This reform will support the Ministry for International Trade and Investment’s broad reform agenda of diversification of PNG’s economy by providing potential investors an alternative financial instrument to mobilize private sector financing.