The latest Bank of Papua New Guinea figures on the economy contain some encouraging news, but also some frank talking from Governor Bakani.

Foreign reserves are declining but import cover is increasing Source: Bank of PNG

1. Although foreign exchange reserves are falling, import cover is improving.

In Bank of PNG Governor Bakani’s recent Economic Outlook for PNG–2016 and beyond, the Governor said the Bank is continuing to support the foreign exchange market by supplying some foreign currency out of its reserves ‘to meet some of the import demand by the private sector.’

‘Bakani said there is a queue in the foreign currency market of non-served orders.’

‘From 2012 to date in 2016, the Central Bank has intervened by supplying US$2.4 billion in the foreign exchange market,’ he commented.

‘With low Government external debt, the private sector has been the beneficiary of the forex intervention. Consequently, Reserves declined from US$4.0 billion at the end of 2012 to US$1.7 billion currently.’

2. ‘Genuine’ import and service payment orders are being cleared but the total orders not being served has changed little.

Bakani said in the Economic Outlook there is a queue in the foreign currency market of non-served orders. But he pointed to ‘good inflows of foreign currencies by exporters’ as a positive development.

The value of PNG’s mineral exports Source: Bank of PNG, Department of Treasury

‘The resumption of Ok Tedi mine in March 2016, combined with Lihir’s increasing production and exports–and inflows by other mineral companies [have also] contributed,’ he said.

Bakani claimed that interventions by the Bank and an increase in foreign exchange inflows was sufficient to clear ‘genuine import and service payment orders’.

But he said ‘the total non-served orders have not declined much.’

3. Concessions given to energy companies are affecting the foreign exchange situation.

Bakani said that ‘after the debt service and accelerated depreciation provisions are catered for’ there will be more foreign exchange inflows from the PNG LNG project. At that point, he said, there will be a ‘turn around in the forex market. He said Government revenue will increase and ‘growth in economic activity will increase.’

‘PNG’s annual imports of agricultural products amounts to about PGK1.2 billion.’

Bakani said the start up of any pipeline projects (such as the Total-led Papua LNG project) will also provide relief to the current financial stresses.

He added that lessons have been learned from ‘ concessions given to extractive projects in the non-renewable sector’, which, he emphasised, should be ‘limited’ in the future.

4. The Bank is hoping for more import substitution.

Bakani said there is a need for exporters to take advantage of the kina depreciation to increase production and exports. ‘That would bring in the much needed foreign exchange,’ he said.

PNG’s annual imports of agricultural products amounts to about PGK1.2 billion, according to Bakani. He observed that if importers and consumers ‘resort to domestically produced goods’ it would reduce foreign exchange demand and support local production.

‘Bakani said the Government is focusing on diversifying the economy by giving emphasis to sectors like agriculture, tourism and the SME sectors.’

Bakani noted that over 80 per cent of PNG’s population is involved in subsistence agriculture.

‘Import substitution will improve the livelihoods of the mass population and help relieve PNG of its current foreign exchange pressure.’

5. The Bank is hoping for greater industry diversification to help deal with the foreign exchange issues.

Bakani said the Government is focussing on diversifying the economy by giving emphasis to sectors like agriculture, tourism and the SME sectors. He pointed to forestry and fisheries as two industries with great potential.

Bakani said there is a need for ‘appropriate’ trade and investment policies to help boost growth in the non-mineral sectors.

‘The Bank has to balance the foreign currency need of the Government, private sector demand and ensure maintenance of adequate level of foreign exchange reserves for the country.’

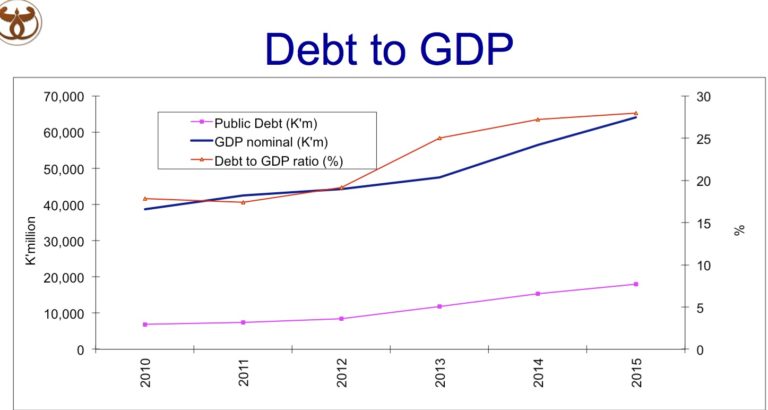

PNG’s Debt to GDP ratios Source: Bank of PNG

Copyright © 2016 Business Advantage International.