By Theckla Gunga – EMTV News, Port Moresby

The PNG Trade Union Congress says there is a need for the national government to review the income taxation rates that will be imposed in 2019.

The call for review in taxation rates come days after media reports recently published revealed the change in the taxation threshold and the percentage charged on different income levels.

Since EMTV News broadcasted a story on the 2019 Income Tax rates, there had been much commentary on social media regarding the rates of personal income tax are in force as of January 1st.

A graph incorrectly stated that the employees earning up to K12,500 would be taxed at 22 percent – this graph based on 2019 National Budget Documents, still available on the Department of Treasury’s website.

Treasurer Charles Abel then clarified the rates of income tax, highlighting that the figures may have been an error in printing.

The treasurer pointed to the fact that the government had given employees at the lowest income level, some reprieve.

But this has not gone down well with the Trade Unions, with the Papua New Guinea Trade Union Congress saying despite the increase in the tax threshold for the first and second-tier levels, the majority of Papua New Guineans in the formal workforce will heavily be penalized.

Through the 2019 National Budget, employees earning K12,500 and less annually, will not be taxed.

This follows an increase of the tax-free threshold from the previous level of K10,000.

Employees earning K12,500 up to K20,000 will pay 22 percent tax. This second-tier tax bracket an increase from 2018 level of K18,000

Employees earning K20,001 up to K33,000 annually will be taxed 33 percent and those earning between K33,001 up to K70,000 annually will pay 35 per cent tax.

Employees who earn between K70,000 up to K200,000 will be taxed 40 percent and those whose annual income exceed K250,000 kina annually will be taxed 42 percent.

While this has created debates on social media platforms, Treasurer Charles Abel, clarified the rates, and also justified the government’s decision to increase the tax-free-threshold, as a way of putting back money into the pockets of the lowest paid employees in the formal sector.

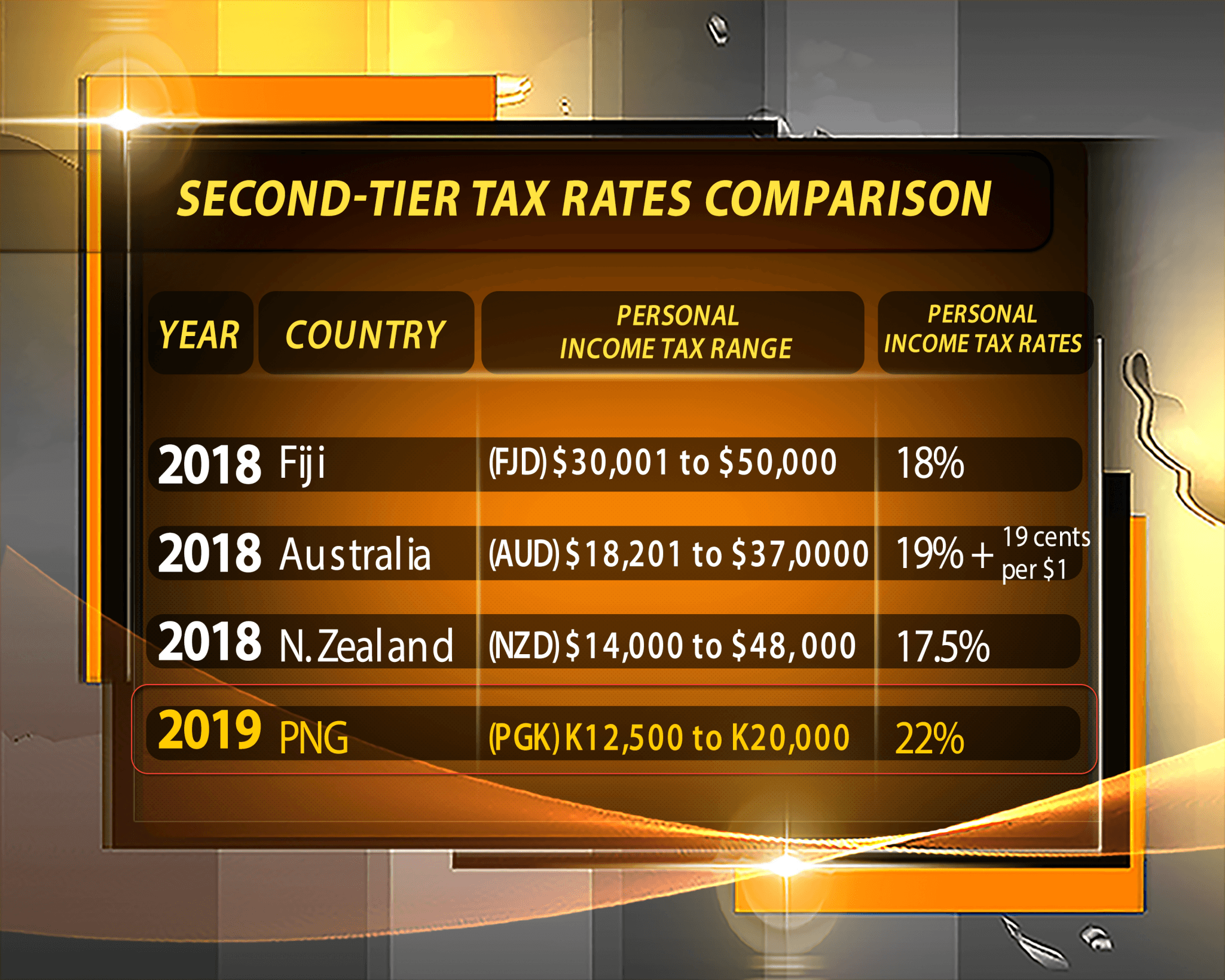

However, the Unions are of the view that the income tax rates in Papua New Guinea are still too high, drawing on comparisons of PNG’s second-tier Income Tax rates with that of Fiji, Australia and New Zealand.

Whilst Papua New Guineans earning up to K20,000 pay a marginal tax of 22 percent, the second-tier tax income tax rates in neighboring countries are as follows;

18 percent for those earning between 30,000 and 50,000 Dollars in Fiji

19 percent for employees earning between 18,001 and 37,000 in Australia, and, 17.5 percent for employees earning between 14,001 dollars and 48,000 Dollars in New Zealand.