![]()

Oil and gas prices are rising but cocoa and silver are weaker. Business Advantage PNG’s monthly review of Papua New Guinea commodities and financial markets.

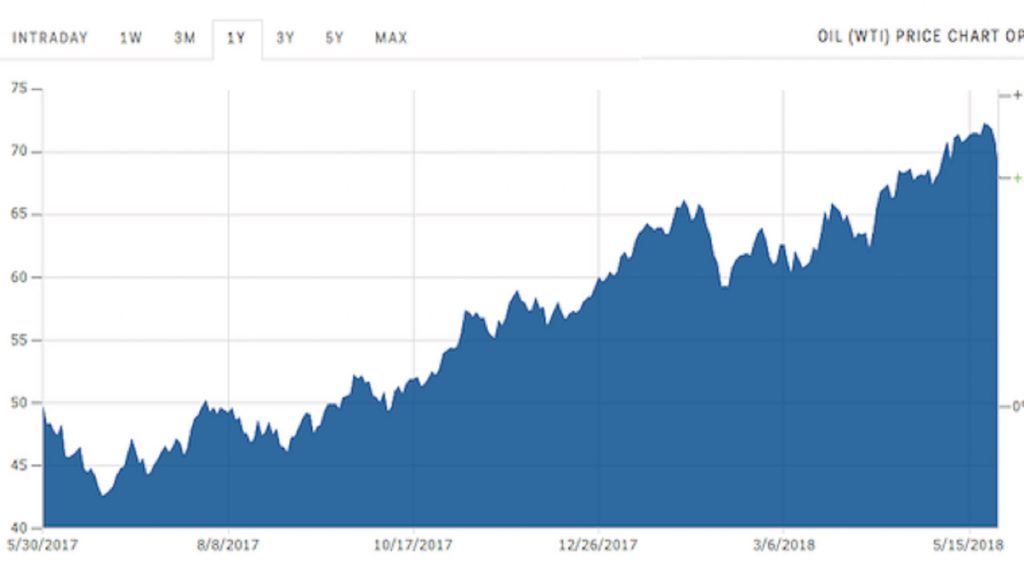

West Texas Intermediate prices over the last year Source: MarketsInsider

Oil prices continue to rise, according to Kina Securities, with West Texas Intermediate up 3.6 per cent for the month. Over the year it is up 17 per cent.

Energy analysts believe the Trump administration’s decision to pull out of the Joint Comprehensive Plan of Action with Iran (an agreement to stop the country developing nuclear weapons) and impose sanctions will probably keep oil and gasoline prices higher than they would have been otherwise. Iran ramped up its oil production by 1 million barrels per day after sanctions were lifted in early 2016.

‘The biggest mover in the agricultural commodities market was cocoa.’

LNG prices were also up sharply, by 18 per cent over the month, according to Kina. LNG has not recovered from its falls over the medium term, however, and remains down by 16.5 per cent over the year.

The sanctions on Iran are expected to ‘filter through to oil-indexed LNG and Russian long-term contracts, resulting in higher prices and influencing European spot gas markets,’ according to Platts.

The copper price over the last year. Source: MarketsInsider

Cocoa

The biggest mover in the agricultural commodities market was cocoa, which fell back after recent rises. The price dropped 7.8 per cent over the month, but it is still up 37.6 per cent over the year, according to Kina.

Coffee was up 2.5 per cent for the month and is down 4.5 per cent for the year.

In the mineral commodities market, gold was steady over the month and is up 2.37 per cent over the year according Market Index.

‘The KSI Index (which includes dual-listed stocks) was up 3.6 per cent over the month.’

Silver was up 0.7 per cent over the month but is down 2.7 per cent over the year.

Copper weakened by 1.2 per cent over the month according to Kina.

Equities

The stock market moved sideways. The KSI Home Index (PNG-listed stocks only) was steady, rising 0.9 per cent per cent over the month, according to Kina. The annual return is 2.1 per cent.

The KSI Index (which includes dual listed stocks) was up 3.6 per cent over the month, but is down by 1.9 per cent over the year.

The Australian All Ordinaries Index was up 2.3 per cent over the month, while America’s S&P 500 also had a monthly return of 2.3 per cent.

Over the month, the kina rose by 4 per cent against the British pound, but was steady against all the other major currencies.

Half-year Treasury Bills are trading at 4.72 per cent, while full-year Bills are trading at 8.04 per cent. Three-year inscribed stock has an interest yield of 9.48 per cent.

Copyright © 2018 Business Advantage International.