By Tamara Pia Agavi

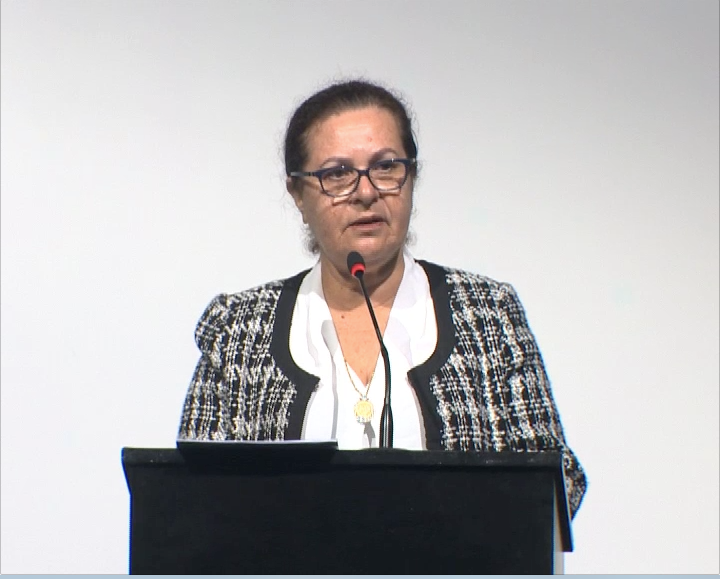

In a breakfast held this morning at the Hilton Hotel in Port Moresby, the second quarterly presentation of the Monetary Policy Statement for September was presented by the Bank of PNG’s Acting Governor, Elizabeth Genia in front of the stakeholders, partners and clients of the Central Bank of Papua New Guinea.

The September 2023 Monetary Policy Statement was issued following proper consideration by the Bank of PNG Board and is endorsed as the Monetary Policy Stance of the Bank of PNG for the next six months.

In her opening remarks, the Acting Governor of the Bank of PNG, gave an insight into the new reader friendly look of this quarter’s reader and it’s easier to grasp as a layman.

“We are all impacted by the Monetary Policy statement decisions and the bank needs to express those decisions simply and clearly” said Genia.

Genia went on to highlight her key topics which were, the bank’s outlook of growth and inflation and the recent adjustments to the monetary policy framework before talking about the foreign exchange rate and the foreign currency availability and also other issues related to the Policy statement.

“Papua New Guinea’s real Gross Domestic Product (GDP) is expected to grow at around 2.5 percent in 2023, compared to the 3.2 percent projected in the March 2023 Monetary Policy Statement” remarked Genia in her summary regarding the BPNG’s projected growth

The Bank will pursue a neutral monetary policy stance over the next six months. The monetary policy stance will be adjusted, when and if required to ensure price stability, employment creation and economic growth, and to ensure macroeconomic stability.

Tune in to EMTV’s InFocus programme on Monday 9th of October to watch the full presentation of the second quarterly monetary policy statement, and a round table discussion on this matter.

The Monetary policy statement for September can also be viewed on the Bank of Papua New Guinea’s online page.