Oil prices are rising and silver is also strengthening. Business Advantage PNG’s monthly review of Papua New Guinea commodity and financial markets.

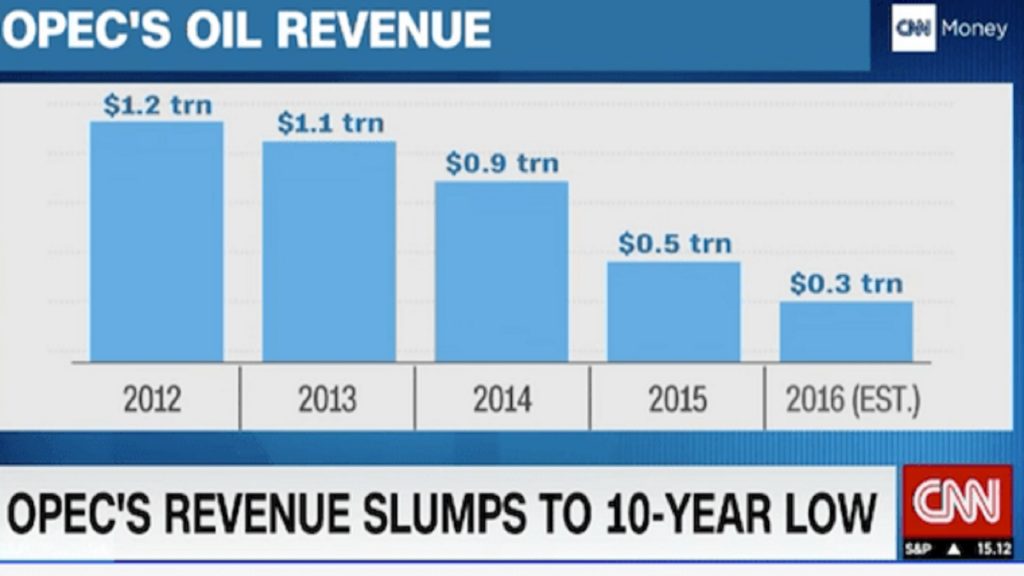

OPEC’s oil revenue has been falling Source: CNN

Oil prices have risen, according to Kina Securities, with West Texas Intermediate up 6.1 per cent for the month. Over the year, it is up 12.8 per cent.

The rise has prompted an attack on OPEC from the President of the United States, Donald Trump, who has claimed that prices are ‘artificially high.’

LNG prices also rose by 6.2 per cent over the month, reports Kina, but are down by almost a third over the year.

‘Chinese demand is forecast to grow by 22 per cent this year.’

According to S&P Global Platts Analysis, China is restructuring its energy mix which is ‘rebalancing the global LNG market’ and changing the prospects for the commodity.

It says China imported 38 million tonnes of LNG in 2017, a 50 per cent year-on-year increase.

The country’s demand is forecast to grow by 22 per cent this year and it is set to surpass Japan to become the world’s largest LNG importer by 2030.

The gold price over the last year Source: MarketIndex

Cocoa and silver

The agricultural commodity markets have been mixed. Cocoa continued to rise, according to Kina, increasing in price by 11.7 per cent over the month, and up 49.6 per cent over the year.

Coffee, however, was weak, falling 4 per cent over the month. It is down 9.5 per cent for the year.

In the precious metals market, gold was steady, and is up 3.87 per cent over the year according to MarketIndex.

‘Copper has maintained its strength.’

Silver is up 4.9 per cent over the month but, according to Zero Hedge, the price has been artificially depressed by ‘massive short selling in the futures market’ and prices should rise by 30 per cent.

Copper has maintained its strength, rising by 4.2 per cent over the month, according to Kina.

Equities

The stock market in PNG moved sideways. The KSI Home Index (PNG-listed stocks only) was steady, rising 1.2 per cent per cent in the month. Over the year, is up 1.4 per cent.

‘The kina was steady against all the major currencies.’

But the KSI Index (which includes dual-listed stocks) had a setback, falling 7 per cent over the month.

In terms of individual stock movements, City Pharmacy fell by 12 per cent over the month, while Newcrest Mining was down by 12.6 per cent. Horizon Oil’s share price was up 7.7 per cent over the month and has risen by 50.5 per cent over the year.

The Australian All Ordinaries Index fell by 1.1 per cent over the month, while America’s S&P 500 was up 1.9 per cent. (In Australia, AMP was down by 17.6 per cent after adverse publicity from the Royal Commission into the banks.)

Over the month, the PNG’s currency, the kina, was steady against all the major currencies.

Half year Treasury Bills are trading at 4.72 per cent, while full year Bills are trading at 8.04 per cent. Three year inscribed stock has an interest yield of 9.46 per cent.

Copyright © 2018 Business Advantage International.